Perfect Meetings in Downtown Phoenix (Without a Car!)

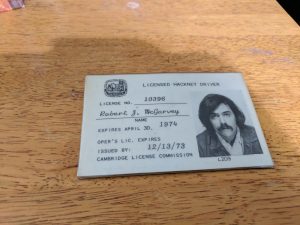

By Robert McGarvey

It’s the season. The downtown Phoenix Convention Center is rocking, the daytime high today will be low 60s (the low was 38 – Phoenix rarely freezes), and suddenly downtown Phoenix is abloom with conventioneers, Arizona State students (there’s a huge downtown campus, a satellite to the main Tempe campus), and the arts venues are throbbing.

Now is the time to discover downtown Phoenix. As recently as 10 years ago it was a lot of dirt. This morning there were, count ‘em, four cranes at work. Every speck of dirt is filling in, generally nowadays with apartments and condos.

Used to be Phoenix and meetings meant in fact Scottsdale, a separate city. Scottsdale still hosts meetings (I used to live next to the Fairmont Princess in Scottsdale, a place that is always busy with meetings).

But my advice is this: cajole your meeting planners to meet downtown.

It’s just so much more fun and, in downtown, you are witnessing the rebirth of an area that had died. There is life downtown, plus extremely good food – Beard award winning – as well as good arts. And you can walk everywhere.

It starts with getting there. Hop the light rail at Sky Harbor, the fare is $2. Yep. Two dollars. Or buy an all day pass for $4. Downtown is maybe 15 minutes west of the airport. You could take a cab but why? It’s no faster.

Where to stay? If yours is a convention center meeting you have plenty of choices. A Kimpton, Hyatt (probably the closest), Renaissance, Hilton Garden Inn (in an old bank building), the FoundRe, Sheraton Grand (also very close), Westin, Hotel San Carlos (a historic hotel – read TripAdvisor before booking, comments are very mixed), and a lot more. Whatever you want is downtown. Well, maybe not a real five diamond property, but there are plenty of choices anyway.

Was me, I’d stay at the Sheraton Grand – Arizona’s largest hotel with 1000 rooms – mainly because of the convenience. But note: the shopping center across the street is an active construction zone. I walk by it just about daily, can’t say it’s especially noisy, but some might complain nonetheless.

Where to eat? The must go is Beard award winning Chris Bianco’s Pizzeria, Eat the Wise Guy pizza ($19), fennel sausage and housemade mozz. Drink a nice Italian red. Reservations are not accepted. Singles are readily accommodated at the bar. If the wait is too long, you can also get food in Bar Bianco next door.

Bianco’s eatery is in Phoenix’s Heritage Square, a collection of very old houses a few short blocks from the convention center. Bianco’s neighbor in Heritage Square is Nobuo, where the chef is also a Beard award winner. The food is Japanese and it is clever, delightful. The tasting menu is $80, for around seven courses.

Next eat at Barrio Cafe Gran Reserva, to me Phoenix’s best Mexican food, from Chef Silvana Salcido Esparza. Go with the set tasting menu (there’s a vegan option that is simply outstanding). You’ll eat authentic Mexican foods that will dazzle you with their originality. Taco Bell this isn’t. The tasting menu – 5 or 6 courses – is $42. A wine pairing – Mexican pours of course – is around $20. Technically, this is well within downtown but my advice is to Uber there and back. Grand Street – where the restaurants is – is a street where many get lost.

What to do? I’ll tell you my three favorite haunts.

Many weekends in season I am at the Phoenix Symphony (nextdoor to the convention center) where the fare usually is classical music. This weekend for instance it’s Sibelius and Debussy. A night of Mozart and Beethoven is coming up. Pops are mixed in – a few Sundays ago I saw a Harry Potter film accompanied by the orchestra. Tickets often are available same day. Prices range from around $45 to a tick over $100.

The only disadvantage: most concerts play weekends only.

But you still have choices during the business week. There’s the Heard Museum ($18), probably the nation’s best Native American fine arts museum – with kitschy, wonderful stuff like Barry Goldwater’s kachina collection. The Heard is open just about every day from 9:30am to 5 p.m. Go and you will see art that surprises.

The Heard, by the way, is in “midtown,” adjacent to downtown. It’s an easy 30 minute walk or take the lightrail west to Encanto. The museum is across the street.

Also go to the Phoenix Art Museum ($18 admission), where I go maybe a few dozen times a year. Closed Mondays. There’s a rotating mix of special exhibits – I loved the Warhol show and was very impressed with a recent exhibition of contemporary Brazilian art. It’s a manageable museum. You can see a lot in an afternoon.

The Phoenix Art Museum also is on the light rail. Get off at McDowell; it’s right there. It’s maybe a 20 minute walk from downtown.

You want more? Stop in at Bitter & Twisted for craft cocktails. Step into St. Mary’s Basilica, the oldest Catholic church in Phoenix (across the street from the convention center). See a play at the Herberger. See a show at the magnificent, restored Orpheum.

The list goes on. There just is so much to do in central Phoenix. And in the winter there is no better city for walking.