Is This the End of Ripoff Hotel Resort Fees?

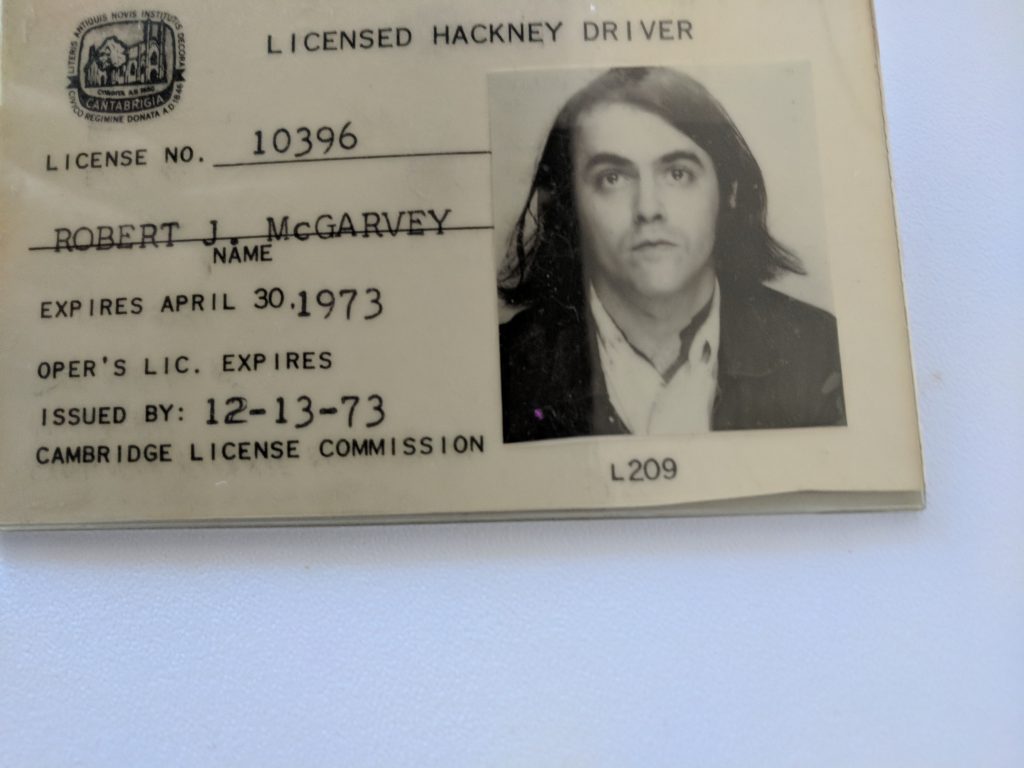

By Robert McGarvey

Washington, D.C. district attorney Karl A. Racine just dropped a bomb on Marriott International – and we all should applaud him.

The target of Racine’s ire: resort fees, charged by increasing numbers of hotels who have decided it is so easy to pick our pockets, they would be fools if they didn’t. So $20, maybe as much as $50 is slapped on our hotel room rates but those numbers don’t show up when we search in Expedia, Trivago, etc.

Resort fees can make a huge difference. Just this a.m. I looked at an Arizona hotel that had a summer special for Arizona residents only. The nightly rate: $224. In the fine print however I’m told there’s a $41 resort fee. That’s a nearly 20% bump.

A guess is that industrywide resort fees now put $2.7 billion, or more, in hoteliers’ pockets yearly.

Enter AG Racine. “Marriott reaped hundreds of millions of dollars in profit by deceiving consumers about the true price of its hotel rooms. Bait-and-switch advertising and deceptive pricing practices are illegal. With this lawsuit, we are seeking monetary relief for tens of thousands of District consumers who paid hidden resort fees and to force Marriott to be fully transparent about their prices so consumers can make informed decisions when booking hotel rooms.”

The lawsuit elaborated: “One key effect of this price deception is that consumers shopping for a hotel room on either Marriott’s website, or an online travel agency site (OTA) like Priceline or Expedia, are misled into believing a Marriott hotel room is cheaper than it actually is.”

Marriott of course has a different take. In an interview on LinkedIn, CEO Arne Sorenson vigorously defended the fees. He said: “You’ve got resort fees in hotels, baggage fees in airlines. None of us as consumers necessarily love it. What we’ve tried to do is be very transparent with disclosure.”

What absolute nonsense.

Everytime we fly we have a choice – do we pay to check a bag or don’t we? Personally I have never paid to check a bag. As in not once.

At many resorts the resort fee is inescapable. Go ahead, try. Say: I don’t plan to swim in the pool, use your idiot gym, don’t want the junk newspaper, and am perfectly happy to be denied all that you bundle in it.

And I definitely don’t want the hotel WiFi which is dangerous to use.

Used to be a loud consumer could talk his/her way out of a resort fee at the check in desk. It has gotten much, much harder. Hotels are digging in their heels.

The greed multiplies. Now more hotels in urban areas are imposing “urban fees.” According to the New York Times the Sofitel in Washington DC slaps guests with a $25 daily fee to cover “premium” Internet access, bottled water, yoga classes, and access to a bike share program. Many, many others are doing likewise.

Is there anything on that list you actually want? Or would use? Maybe the bottled water.

Some 55 hotels in San Francisco are reported to charge a resort or urban fee, for instance.

Back up a step. Is there real reason to believe now is a moment when resort and urban fees may in fact vanish?

I have written about resort fees for some years. Nothing changed except the fees got bigger and more resorts and hotels charged them.

Now things look different however.

According to Skift, “’The real takeaway from this lawsuit is to have an important jurisdiction file against a big company,’ said [NYU’s Bjorn] Hanson. ‘Other hotels will have to wait and see what happens, but other states and jurisdictions will feel that now is the time to go after them.’”

Hospitality lawyer Jim Butler notes this: “We have cautioned that consumer frustration over this issue is very high, and government agencies have periodically shown significant interest in jumping on a populist bandwagon. But today, it looks like the situation may have finally reached a turning point.”

What’s an individual hotel guest to do? Act on what Hanson said. Write your state attorney general and urge him/her to follow in Washington, D.C.’s lead. Handy list here. Another list here.

For an ambitious AG in a Democratic state, it’s an easy and sure way to grab headlines, win better name recognition, and get known as a consumer advocate. Goodby AG, hello governor.

Yes, hoteliers don’t like what they see coming. But it’s hard to have sympathy for folks who have been picking our pockets since perhaps 1997.